A Guide to Help You Purchase Reverse Mortgage for Your Retirement Plan

A Guide to Help You Purchase Reverse Mortgage for Your Retirement Plan

Blog Article

Empower Your Retirement: The Smart Means to Purchase a Reverse Mortgage

As retired life methods, many individuals look for reliable techniques to boost their economic freedom and well-being. Amongst these strategies, a reverse home mortgage becomes a viable option for property owners aged 62 and older, allowing them to take advantage of their home equity without the requirement of monthly repayments. While this economic tool provides a number of advantages, consisting of increased capital and the possible to cover crucial costs, it is vital to understand the ins and outs of the application process and key considerations included. The following steps might expose how you can make a knowledgeable choice that can considerably affect your retired life years.

Understanding Reverse Home Loans

Understanding reverse home mortgages can be crucial for homeowners seeking monetary versatility in retired life. A reverse mortgage is a monetary item that enables eligible house owners, typically aged 62 and older, to convert a section of their home equity right into cash money. Unlike standard home mortgages, where customers make regular monthly payments to a lending institution, reverse home loans make it possible for house owners to obtain repayments or a swelling amount while retaining ownership of their building.

The amount offered via a reverse home mortgage relies on a number of variables, consisting of the house owner's age, the home's worth, and present rate of interest prices. Notably, the car loan does not need to be paid off until the house owner offers the home, vacates, or passes away.

It is essential for possible debtors to understand the effects of this economic item, consisting of the influence on estate inheritance, tax factors to consider, and continuous responsibilities related to home maintenance, tax obligations, and insurance policy. Additionally, counseling sessions with certified experts are frequently needed to ensure that customers totally comprehend the terms of the car loan. Overall, a detailed understanding of reverse home loans can empower homeowners to make educated choices regarding their financial future in retired life.

Advantages of a Reverse Home Mortgage

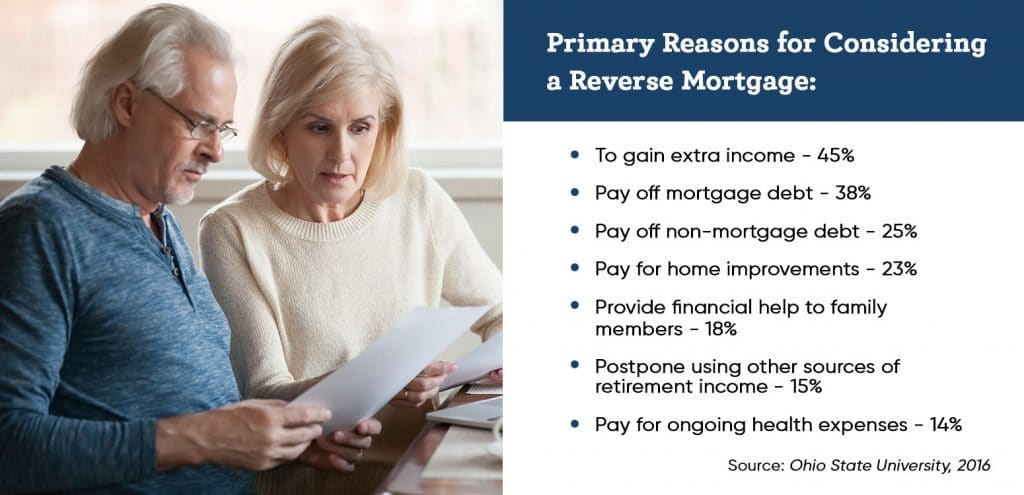

A reverse mortgage provides a number of engaging advantages for qualified property owners, especially those in retired life. This financial tool allows senior citizens to convert a section of their home equity into cash money, giving important funds without the requirement for regular monthly mortgage repayments. The cash gotten can be made use of for different purposes, such as covering medical expenses, making home renovations, or supplementing retired life income, thus boosting general financial adaptability.

One substantial advantage of a reverse home mortgage is that it does not require settlement until the house owner moves out, markets the home, or passes away - purchase reverse mortgage. This attribute allows retirees to keep their way of living and satisfy unforeseen costs without the burden of month-to-month repayments. Furthermore, the funds obtained are typically tax-free, enabling house owners to utilize their cash without concern of tax effects

In addition, a reverse mortgage can give satisfaction, understanding that it can work as an economic safeguard throughout difficult times. Property owners also retain possession of their homes, ensuring they can continue staying in a familiar atmosphere. Eventually, a reverse home loan can be a tactical funds, equipping retirees to handle their financial resources successfully while appreciating their golden years.

The Application Refine

Navigating the application process for a reverse home loan is an important action for published here home owners considering this economic alternative. The initial stage involves assessing qualification, which normally requires the home owner to be at the very least 62 years of ages, very own the residential or commercial property outright or have a reduced home mortgage balance, and inhabit the home as their main house.

As soon as qualification is confirmed, house owners have to undertake a therapy session with a HUD-approved counselor. This session guarantees that they fully comprehend the implications of a reverse home mortgage, consisting of the duties included. purchase reverse mortgage. After completing therapy, candidates can continue to collect needed documents, including proof of income, assets, and the home's worth

The next step entails sending an application to a lending institution, who will assess the financial and residential or commercial property qualifications. An evaluation of the home will likewise be conducted to establish its market value. If accepted, the lending institution will certainly provide finance terms, which should be examined very carefully.

Upon approval, the closing process complies with, where last records are signed, and funds are disbursed. Comprehending each stage of this application procedure can substantially improve the homeowner's self-confidence and decision-making concerning reverse home loans.

Secret Considerations Prior To Getting

Purchasing a reverse home mortgage is a significant financial choice that calls for mindful consideration of numerous essential variables. Examining your financial requirements and objectives is similarly important; establish whether a reverse mortgage straightens with your long-lasting plans.

A reverse home loan can impact your eligibility for particular government advantages, such as Medicaid. By completely reviewing these factors to consider, you can make a much more informed choice about whether a reverse home loan is the appropriate financial approach for your retired life.

Making the Many of Your Funds

Once you have secured a reverse home loan, properly managing the funds becomes a top priority. The adaptability of a reverse home loan allows homeowners to utilize the funds in numerous methods, but calculated preparation is necessary to maximize their benefits.

One essential approach is to create a spending plan that web link details your regular monthly costs and financial goals. By identifying essential costs such as medical care, real estate tax, and home upkeep, you can allot funds accordingly to make certain long-term sustainability. Additionally, consider making use of a section of the funds for investments that can generate earnings or appreciate gradually, such as dividend-paying supplies or common funds.

Another essential aspect is to preserve a reserve. Reserving a get from your reverse home mortgage can help cover unexpected costs, offering assurance and monetary security. Additionally, seek advice from an economic expert to explore possible tax effects and just how to integrate reverse home mortgage funds into your general retirement technique.

Inevitably, prudent administration of reverse home loan funds can improve your economic safety, allowing you to enjoy your retired life years without the stress and anxiety of monetary unpredictability. Mindful planning and notified decision-making will certainly make certain that your funds function properly for you.

Conclusion

Finally, a reverse mortgage presents a viable financial this post technique for seniors seeking to improve their retirement experience. By transforming home equity right into available funds, individuals can attend to important expenditures and safe extra financial sources without incurring month-to-month settlements. However, mindful factor to consider of the connected terms and implications is vital to make best use of advantages. Inevitably, leveraging this economic tool can facilitate better independence and improve overall high quality of life during retired life years.

Recognizing reverse home loans can be vital for property owners looking for monetary adaptability in retired life. A reverse mortgage is a financial product that allows eligible homeowners, typically aged 62 and older, to convert a part of their home equity right into cash money. Unlike typical home loans, where customers make monthly payments to a loan provider, reverse home loans enable house owners to get payments or a swelling sum while preserving possession of their residential property.

Overall, a complete understanding of reverse mortgages can encourage house owners to make informed choices regarding their monetary future in retirement.

Consult with an economic expert to explore possible tax ramifications and just how to incorporate reverse home mortgage funds into your total retirement method.

Report this page